This quarter we have been focusing on customer satisfaction and loyalty, described these days as the ‘Customer Experience’. We’ve learned the importance of the experience (the why), and a little about designing your measurement (the how). The next, and arguably most important, step is understanding how to make the results actionable (yes, that is where our name came from).

The Big Picture

Measuring the customer experience (CX) is important, but it’s only useful if the information can help you make a difference for your customers. Measuring CX should not just be an exercise – unless it has some “teeth” to it, you might as well save your time and money.

The ultimate goal is to take what you learn and make a positive impact on your business by doing better for your customer, providing your company with a competitive advantage. Your product or service needs to perform, for sure, but if you can demonstrate your desire to respond to the customer feedback and improve their experience, you will realize competitive gains.

You Have to Prioritize

No matter how good your CX measurement system is, there are still risks involved when you make changes based on customer feedback. What are those risks?

- Making changes to the wrong service/touchpoint will not result in improved loyalty

- Disregarding customer sentiment will remove any competitive advantage

- Improving touchpoints that aren’t important to customers is a waste of resources

In short, you have to know what is not working for customers (or not working well enough), and prioritize those touchpoints so that you are improving things that will actually make a difference to your customers.

Everything Is Important

The most imperitive part of this exercise is properly testing importance. The problem most researchers have, however, is that they ask customers what is important to them. The answer: everything is important to some extent or another. Sure, there are shades of grey when it comes to importance, but in the end customers aren’t usually able to articulate which ones actually make them loyal.

Additionally, a reoccurring issue is finding the right questions to ask. For example, if you ask airline passengers which attributes of travel are important to them, safety will be #1 every time. Of course, safety is important, but it is a required metric that should not be included in a study like this. Every airline values safety and makes it a priority, it’s the other aspects of travel (comfort, cost, amenities, etc.) that affect consumer decisions, and therefore are important to understand.

Derived Importance

The best way to prioritize attribute importance is to correlate importance with behavior. To do this, our researchers use a composite loyalty index to simulate customer behavior. The index will include different questions and language depending on your industry, but will usually include metrics concerning overall satisfaction, recommendation, repurchase, and desire to switch. Responses are aggregated into an overall score that defines a participant’s likelihood of being loyal to the brand.

Once you have this data, you can use a regression model to correlate attributes of their experience with their loyalty index score. The higher the correlation, the more important an attribute is to predicting loyalty. Best practice is to correlate overall satisfaction for a high-level attribute (customer service, sales, reps, etc.) to the overall loyalty index first to see what group is driving higher or lower scores.

The Satisfaction Scale

It is common to use a standard satisfaction score (from “Very Satisfied” to “Very Unsatisfied”) in these cases. Satisfaction scales are an easy way to understand how people feel about things in an easy format, but they have their limitations.

At Actionable, we prefer a disconfirmation scale, pioneered by Dr. Roland Rust and colleagues in Return on Quality as a better measure of customer satisfaction. When you ask about satisfaction among a group of people, each may give you the same response (e.g. mostly satisfied). But how do we know if each person’s definition of “satisfied” is the same? The disconfirmation scale removes this concern by asking how an attribute is performing against their expectations:

- Much better than expected

- Slightly better than expected

- As expected

- Slightly worse than expected

- Much worse than expected

If you understand how well you are meeting the expectations of your customers it removes any discontinuity of definition. Expectations differ greatly by person, but if you meet or exceed expectations, you will improve loyalty.

Putting It All Together

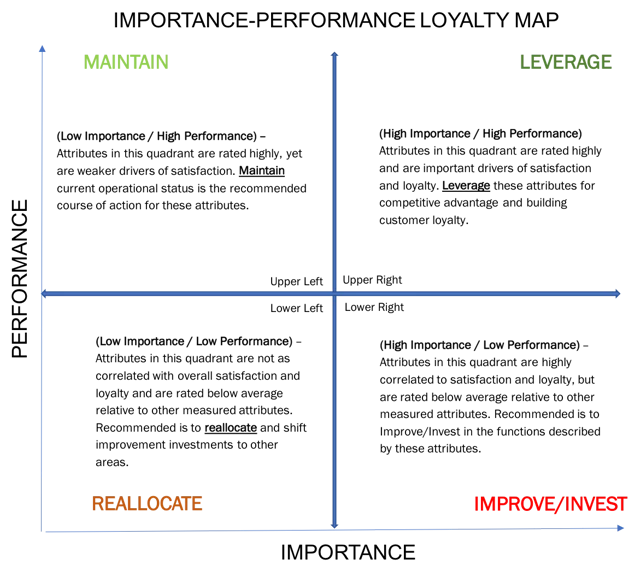

After you have satisfaction levels (based on expectations) and attribute importance (derived using the loyalty index), it’s time to bring them together:

Clockwise from Lower Left:

- Low Importance / Low Performance: these attributes are not likely to improve loyalty, but they are still not performing up to expectations. Only discretionary resources should be used on these after the other attributes are attended to.

- Low Importance / High Performance: these attributes are not likely to make much impact on loyalty, but they are performing well. Resources should be maintained here.

- High Importance / High Performance: these attributes are highly important to your customers and they are performing above expectations. These attributes differentiate you against competitors and representative a competitive advantage.

- High Importance / Low Performance: these are your low hanging fruit. They are highly important, but not performing to a level that contributes to loyalty (below expectations). This is where you should start.

It’s important to note that the attribute location might change as you conduct more research. If an attribute requires change and it is improved, other attributes might jump to the top of the priority list that need improvement. It’s also important to note that there are usually no “unimportant” attributes. Some are just more important right now based on their likelihood of predicting loyalty and their current performance.

Actionable Is What We Do

Actionable Research has been conducting this type of research for almost 20 years. Customer experience research has been an important part of our business, and continues to offer in-depth insights to our customers that want to do more than just ‘ask questions’. If you are interested in taking the next step in your CX endeavors, contact us today.